Save money on your heating costs, while maintaining a cozy home

Let’s face it, Minnesota winters can be unpredictable. With your heating system enrolled in an Energy Wise home heating program, you can save money and alleviate unpredictable winter heating bills.

How it works:

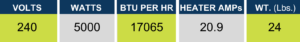

- This is a voluntary program for electric heating products. Products are switched to a backup heat source during peak electricity usage times. This is for any type of permanently-wired electric heating system that’s a minimum of 5,000 watts (5 kW).

- Members save by paying lower rates and it helps MVEC reduce its wholesale electric bill. By avoiding peak use periods, MVEC does not have to pay premium prices when purchasing power from its wholesale power providers, who in turn, lower the need to build new coal plants. It’s a win-win for everyone.

- Wiring and installation costs vary and are the member’s responsibility. Installation is available through MVEC’s network of local contractors. A wiring affidavit is required before MVEC can install the Energy Wise meter. Rebates available.

In-Floor Boiler

Plenum Heaters

Garage Heaters

Baseboard Heaters

Cove Heaters

Fan-Forced Heaters

Air Source Heat Pumps

Mini-Split Heat Pumps

Ground Source Heat Pumps

To help with your heating bill, also consider:

- Budget Billing – pay a set amount each month. This is great for budgeting your monthly utility costs to have a consistent payment amount each month of the year.

- SmartHub – is not just a bill payment app – you can also view your energy usage daily, monthly or weekly to avoid surprises before your bill arrives and have the ability to make usage adjustments, if you wish.

- Heating Sales Tax Exemption – gives Minnesota residents a break from sales tax on electric heating costs, if at least 50% of your heating comes from electricity.

- WiFi Thermostat program – allows you to set and forget the temperature settings in your home with programmable WiFi thermostat. Set it low overnight or when you’re at work and set it to automatically raise in time for waking up or coming home.

Questions?

For more information, contact an energy specialist

952.492.2313 or 800.282.6832 or email [email protected]

Warm up your feet! This product is an economical heating solution for your home. There are many applications available – porches, bathrooms, kitchens, foyers, basements and garages. It is safe, quiet and offers great comfort control.

Warm up your feet! This product is an economical heating solution for your home. There are many applications available – porches, bathrooms, kitchens, foyers, basements and garages. It is safe, quiet and offers great comfort control. A Plenum Heater is a simple inexpensive way to add electric heat to your forced-air heating system. The unit fits in the duct work above the gas or oil furnace and comes in a variety of sizes to fit most applications. It contains electric coils and when the thermostat calls for heat, the coils activate.

A Plenum Heater is a simple inexpensive way to add electric heat to your forced-air heating system. The unit fits in the duct work above the gas or oil furnace and comes in a variety of sizes to fit most applications. It contains electric coils and when the thermostat calls for heat, the coils activate.

Installed along the floor or “baseboard” area of a room, this type of heater is an excellent option for existing homes due to the flexibility and ease of installation. The key to baseboard heaters is airflow. Anything blocking the air flow into and out of the unit will decrease the energy efficiency.

Installed along the floor or “baseboard” area of a room, this type of heater is an excellent option for existing homes due to the flexibility and ease of installation. The key to baseboard heaters is airflow. Anything blocking the air flow into and out of the unit will decrease the energy efficiency. This type of heater (looking similar to a baseboard heater) is available in a convenient wall mount near your ceiling. This is a great option for individual room control.

This type of heater (looking similar to a baseboard heater) is available in a convenient wall mount near your ceiling. This is a great option for individual room control. A fan-forced heater is capable of blowing warm air throughout a room. This recessed heating unit typically is installed on a wall or ceiling.

A fan-forced heater is capable of blowing warm air throughout a room. This recessed heating unit typically is installed on a wall or ceiling.